When a brand new wallet makes a large first trade on Polymarket, should you copy them? We analyzed 198 new whale buy transactions from December 2025 to find out.

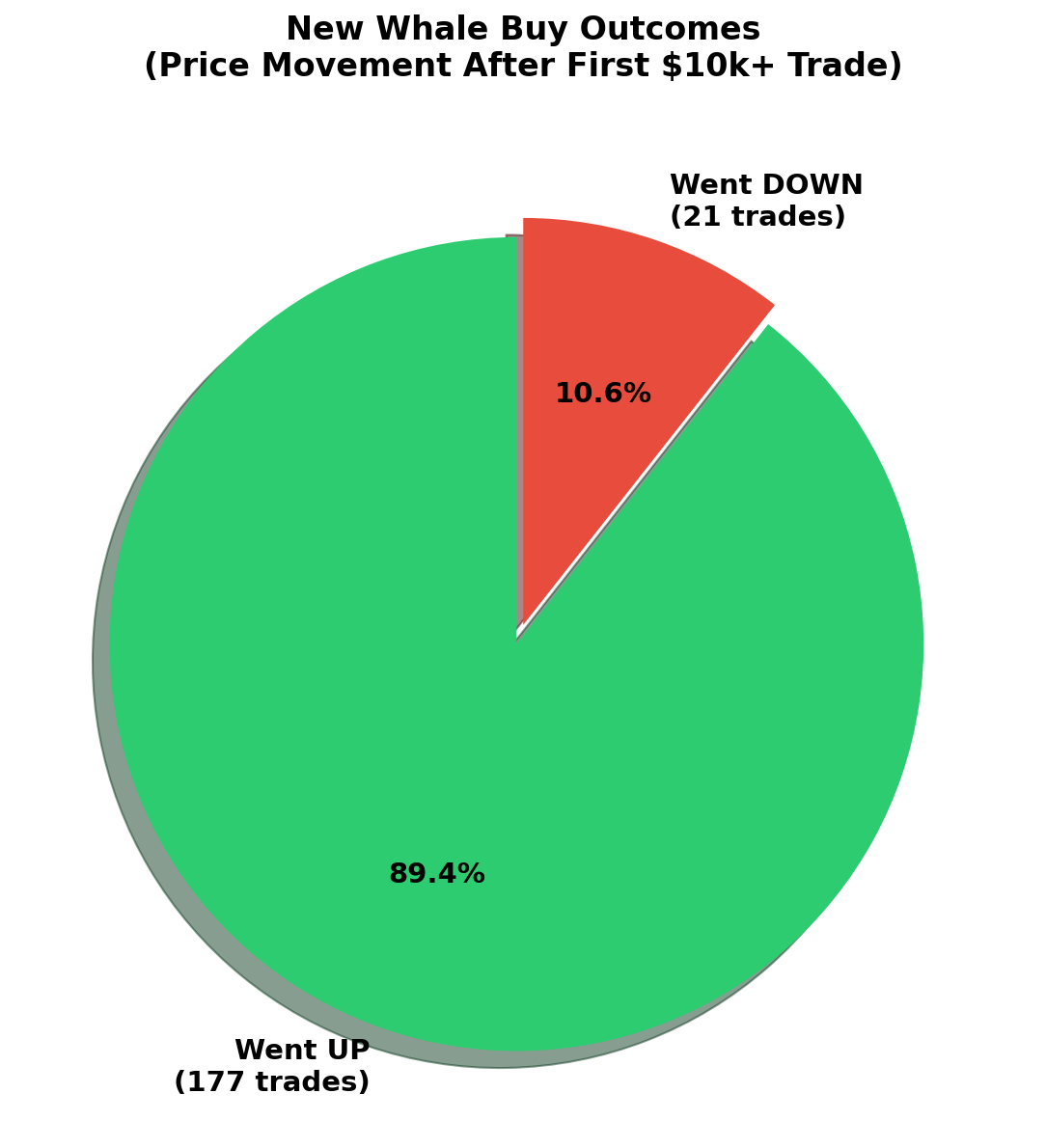

The result: 89.4% of these trades went UP.

The Hypothesis

New wallets making $5,000+ first trades aren’t random retail traders. They’re likely:

- Information-advantaged - They know something the market doesn’t

- Sophisticated analysts - They’ve done deep research before entering

- Insiders or connected parties - Moving funds through fresh wallets

If these assumptions hold, following their trades should be profitable.

The Data

We queried Polymarket’s on-chain data for wallets that:

- Made their first trade ever between December 1-15, 2025

- That first trade was a BUY order

- The trade size was at least $5,000 USDC

SQL Query to Find New Whales

WITH wallet_first_trades AS (

SELECT

wallet,

MIN(block_timestamp) as first_trade_time

FROM polymarket.polymarket_order_filled

GROUP BY wallet

)

SELECT

t.wallet as wallet,

t.block_timestamp as block_timestamp,

t.asset as asset,

t.amount_usdc / 1e6 as usdc_amount,

t.amount_token / 1e6 as token_amount

FROM wallet_first_trades wft

INNER JOIN polymarket.polymarket_order_filled t

ON wft.wallet = t.wallet

AND wft.first_trade_time = t.block_timestamp

WHERE wft.first_trade_time >= '2025-12-01'

AND wft.first_trade_time < '2025-12-15'

AND t.side = 'B' -- Buy orders only

AND t.amount_usdc / 1e6 >= 5000

ORDER BY t.block_timestamp

Output:

Found 689 new whale buy transactions

Total USDC volume: $13,275,384.00

Average buy size: $19,267.61

Median buy size: $9,990.00

Largest buy: $323,371.99

Unique wallets: 525

Unique assets: 146

Tracking Price Movements

For each whale buy, we tracked how the price moved afterward:

# For each whale buy, query subsequent trades to calculate returns

query = f"""

SELECT

block_timestamp,

amount_usdc / 1e6 as amount_usdc,

amount_token / 1e6 as amount_token

FROM polymarket.polymarket_order_filled

WHERE asset = '{asset_id}'

AND block_timestamp > '{buy_time}'

AND block_timestamp < '{end_time}'

AND amount_token > 0

ORDER BY block_timestamp

"""

trades = db.query_df(query)

trades['price'] = trades['amount_usdc'] / trades['amount_token']

# Calculate returns

max_price = trades['price'].max()

min_price = trades['price'].min()

final_price = trades['price'].iloc[-1]

max_return_pct = ((max_price - buy_price) / buy_price) * 100

max_drawdown_pct = ((min_price - buy_price) / buy_price) * 100

final_return_pct = ((final_price - buy_price) / buy_price) * 100

The Results

| Metric | Value |

|---|---|

| Success Rate | 89.4% went UP |

| Failure Rate | 10.6% went DOWN |

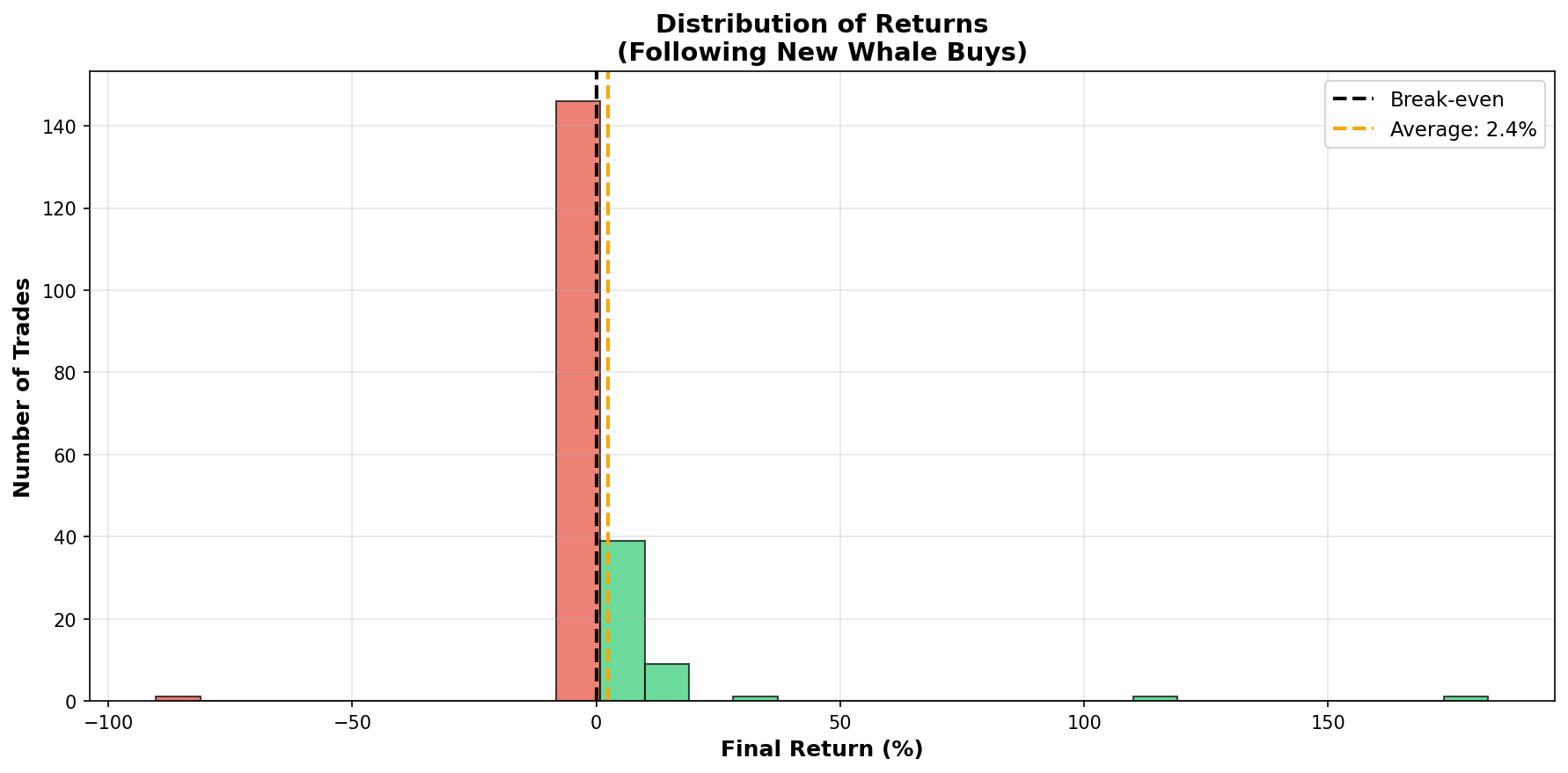

| Average Max Return | +2.8% (peak profit potential) |

| Average Max Drawdown | +0.4% (worst case loss) |

| Average Final Return | +2.4% (if held to end) |

Why This Works

An 89.4% success rate is far better than random (which would be ~50%). Here’s what we believe is happening:

-

Information Advantage: New whales often have private information about market outcomes. Using fresh wallets keeps their identity hidden.

-

Superior Analysis: These traders may simply be better at research. A $5k+ first bet suggests high conviction.

-

Market Impact: Large buys move the price. The whale’s own purchase may push the market in their favor, at least temporarily.

Risk Management

While the win rate is high, not every trade succeeds. Key considerations:

- Position sizing: Don’t go all-in on any single whale follow

- Stop-loss: Consider exit if the trade drops 5-10%

- Timing: Entry price matters - don’t chase if the price has already moved significantly

Caveats

This analysis has limitations:

- Time period: Only 2 weeks of data (Dec 1-15, 2025)

- Survivorship bias: We only see trades that got filled

- Execution: Following in real-time has slippage and timing challenges

- Market conditions: Results may vary in different market environments

Conclusion

New whale traders on Polymarket appear to be a strong signal. With an 89.4% success rate and +2.4% average returns, following large first-time buyers shows positive expected value.

Key Takeaways:

- New whales with $5k+ first trades have information or conviction that translates to profits

- A simple “copy the whale” strategy has positive expected value

- Proper risk management (stop-loss) can improve returns further

- This is a data-driven, backtested result - not speculation

The complete code and data for this analysis is available in our research repository. Always do your own research and never risk more than you can afford to lose.